With October 31 right around the corner, many of us are thinking about carving pumpkins, scary movies [or the timeless classic “It’s The Great Pumpkin, Charlie Brown”], and candy of course. Lots of candy. And depending on where you live and how populated your area is with children, you may or may not get a hoard of trick or treaters. We’re talking about Halloween of course. The first of the fall holidays, the tradition is rooted in the ancient Celtic festival of Samhain. By the eighth century Pope Gregory III marked November 1 as a time to honor saints. When all Saints Day borrowed some of the activities from Samhain, the evening before became known as All Hallows Eve and later Halloween.

With October 31 right around the corner, many of us are thinking about carving pumpkins, scary movies [or the timeless classic “It’s The Great Pumpkin, Charlie Brown”], and candy of course. Lots of candy. And depending on where you live and how populated your area is with children, you may or may not get a hoard of trick or treaters. We’re talking about Halloween of course. The first of the fall holidays, the tradition is rooted in the ancient Celtic festival of Samhain. By the eighth century Pope Gregory III marked November 1 as a time to honor saints. When all Saints Day borrowed some of the activities from Samhain, the evening before became known as All Hallows Eve and later Halloween.

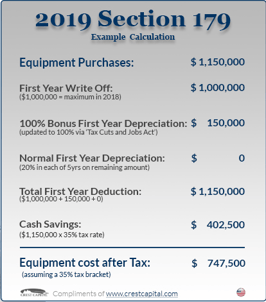

For businesses the IRS has a “treat” in the form of a Section 179 Deduction. The incentive allows taxpayers to deduct the cost of personal property such as machinery and equipment purchased for use in a trade or business. In addition, the Tax Cuts and Jobs Act (TCJA) amended the definition of qualified real property to mean “qualified improvement property and some improvements to nonresidential real property such as roofs, heating/air conditioning and alarm systems.

For businesses the IRS has a “treat” in the form of a Section 179 Deduction. The incentive allows taxpayers to deduct the cost of personal property such as machinery and equipment purchased for use in a trade or business. In addition, the Tax Cuts and Jobs Act (TCJA) amended the definition of qualified real property to mean “qualified improvement property and some improvements to nonresidential real property such as roofs, heating/air conditioning and alarm systems.

This year the IRS Section 179 deduction is $1 million. The deduction limit on equipment purchases is $2.5 million. Bonus depreciation is 100 percent and has been made retroactive to September 27, 2017 and good through 2022. The 2019 Section 179 Calculator shows you how this tax deduction affects your company.

If you are thinking about making an equipment purchase now is the time to do it. Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed within the current tax year. Leasing a piece of equipment also qualifies for this deduction. It’s an incentive for business owners to re-invest in their organizations.